san francisco gross receipts tax instructions

Gross Receipts Tax Applicable to Financial Services. The instructions provided with California tax forms are a summary of California tax law and are only intended to aid taxpayers in preparing their state income tax returns.

Calfresh San Francisco 2022 Guide California Food Stamps Help

San francisco gross receipts tax instructions Tuesday March 15 2022 Edit However the gross receipts of an airline or other person engaged in the.

. For you and your family. Watch our instructional videos on filing your. To begin filing your 2020 Annual Business Tax Returns please enter.

Your seven 7 digit Business Account Number. If eligible based on your filing your refund will be processed. And Miscellaneous Business Activities.

New Venture Fund 2020 Form 990 PDF Irs Tax Forms 501. The Homelessness Gross Receipts Tax is applied to combined San Francisco taxable gross receipts above 50000000The small business exemption threshold for the Commercial Rents Tax is 2000000 in combined San Francisco gross receipts from all. Article 12-A of the San Francisco Business and Tax Regulations Code provides rules for determining San Francisco payroll expense.

To avoid late penaltiesfees the returns must be submitted and paid o n or before February 28 2022. Obligation Summary Calculation of Fees Line A - 2021 Taxable San Francisco Gross Receipts. If eligible based on your filing your refund will be processed automatically.

Gross Receipts Tax Applicable to Construction. For entities and combined groups with San Francisco-sourced gross annual receipts of over 50 million the Homelessness Gross Receipts Tax imposes an additional rate ranging from 0175 to 0690 depending on the line of business. The small business exemption threshold for the Commercial Rents Tax is 1170000 in combined San Francisco gross receipts from all business activities not just receipts from the lease of commercial space.

All persons operating or doing business within the city limits of South San Francisco are required to obtain a business license and pay the applicable fee per the Municipal Code including businesses that operate from home. The Homelessness Gross Receipts Tax is applied to combined San Francisco taxable gross receipts above 50000000The small business exemption threshold for the Commercial. San Francisco Tax Collector PO.

The San Francisco Office of the Treasurer and Tax Collector Tax Collector has released a form for taxpayers to request a two-month extension of. You ARE ENCOURAGED to file if your 2020 payroll expense was less than 320000 or gross receipts was less than 1200000 AND you made estimated quarterly payments toward 2020 San Francisco taxes as you may be eligible for a refund. The last four 4 digits of your Tax Identification Number.

Persons other than lessors of residential real estate ARE REQUIRED to file a Return for tax year 2018 if in 2018 you were engaged in business in San Francisco as defined in Code section 62-12 qualified by Code sections 9523. The City began making the transition to a Gross Receipts Tax from a Payroll Tax based on wages paid to employees in 2014. Administrative and Support Services.

Displays the gross receipts that was entered on the previous screen. Your seven 7 digit Business Account Number. Estimated SF Gross Receipts The estimated amount of San Francisco gross receipts expected during the current calendar year.

2020 Open to Public Department. For a detailed discussion of this tax access PwCs prior Insight here. We will contact you with instructions if the exemption is denied.

Over the next few years the City will phase in the Gross Receipts Tax and reduce the Payroll Expense Tax. San Francisco Tax Collector PO. The Gross Receipts Tax small business exemption threshold is 2000000 of combined gross receipts within the City.

File Annual Business Tax Returns 2021 Instructions. Gross Receipts Tax Applicable to Private Education and Health Services. If business license fees are not received by.

E The amount of gross receipts from retail trade activities and from wholesale trade activities subject to the gross receipts tax shall be one-half of the amount determined under Section 9561 plus one-half of the amount determined under Section 9562. City and County of San Francisco Office of the Treasurer Tax Collector 2020 Annual Business Tax Returns. Taxpayers deriving gross receipts from business activities both within and outside San Francisco must generally allocate andor apportion gross receipts to San Francisco using rules set forth in.

In general gross receipts includes the total amounts received or accrued by a person. The San Francisco Office of the Treasurer and Tax Collector recently issued Gross Receipts Tax regulations tax return filing instructions and other. Business license renewal fees are due by January 31st of the calendar year.

Individuals abroad and more. File Annual Business Tax Returns 2021 Instructions. Businesses operating in San Francisco pay business taxes primarily based on gross receipts.

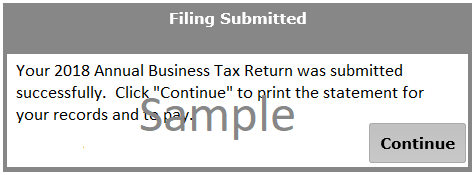

These online instructions provide a summary of the applicable rules to assist you with completing your 2018 return. The Homelessness Gross Receipts Tax is applied to San Francisco taxable gross receipts above 50000000. Which States Have a Gross Receipts Tax.

Include only the payment stub with your payment. The San Francisco Annual Business Tax Returns include the Gross Receipts Tax Administrative Office Tax Commercial Rents Tax and Homelessness Gross Receipts Tax. And Professional Scientific and Technical Services.

Homelessness Gross Receipts Tax

San Francisco Giants Gate Receipts Ticketing 2021 Statista

California San Francisco Business Tax Overhaul Measure Kpmg United States

Renters Lease Agreement Real Estate Forms Rental Agreement Templates Lease Agreement Rental Application

San Francisco Bri Benefit Resource

Property Tax Search Taxsys San Francisco Treasurer Tax Collector

Annual Business Tax Return Instructions 2018 Treasurer Tax Collector

Homelessness Gross Receipts Tax

San Francisco S Overpaid Ceo Tax Measure Targets Disparity Calmatters

Commercial Rents Tax Cr Treasurer Tax Collector

Employee Retention Tax Credit Ertc San Francisco

/cdn.vox-cdn.com/uploads/chorus_asset/file/19534389/EC_Collaboration_PChang_5385.0__1_.jpg)

New Market Hall Will Attempt To Lure Mid Market Tech Workers With Cult Favorite Restaurants Eater Sf

San Francisco Giants Revenue 2021 Statista